The job of the financial advisor is to accompany and guide people in making decisions related to their finances and investments. Having the services of a financial advisor can help us to avoid costly mistakes, to reach our goals and the long-awaited financial independence in a faster way.

If you are considering hiring the services of a financial advisor, review these 6 benefits that will bring you to have one by your side:

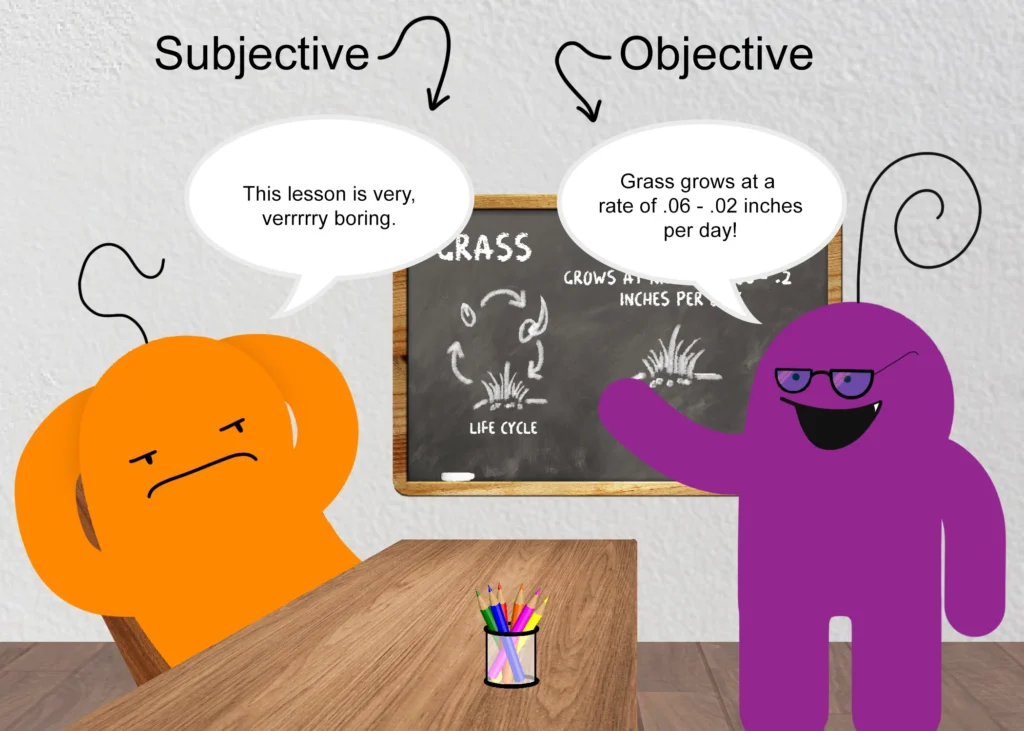

Objectivity in information

When an executive of a bank or financial institution offers you advice, most of the time he is trying to sell you some product. By not working for any broker or financial institution, the only interest of a financial advisor is to find the product or plan that most benefits their client; always taking into account their specific characteristics, objectives and level of risk that is willing to take. He knows that his success depends on the success of his client and that the best reference of his work is a satisfied client.

Another advantage of the financial advisor like Ed Rempel Brampton, is that by not being employed by a financial institution, you can perform a more complete and detailed analysis of the alternatives that exist in the market, which will influence a good negotiation or the acquisition of a financial product.

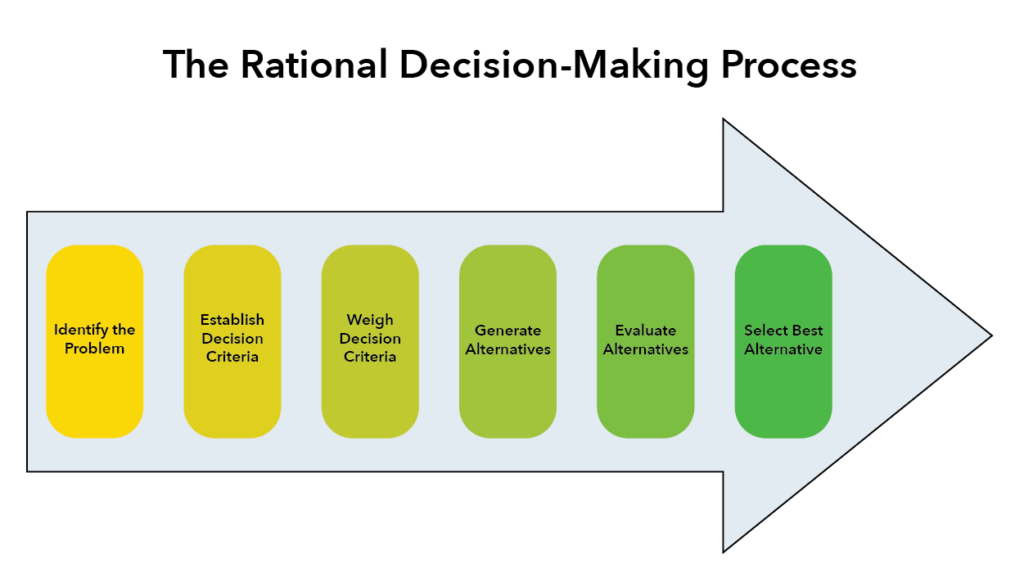

Induce rational decision-making

When it comes to our money, we sometimes make unsound decisions. This idea has given rise to a new branch of finance, known as “behavioral finance”. a psychologist who won the Nobel Prize in Economics in 2002, is one of the forerunners of this field of finance. In his work, he studied how factors such as emotions, overconfidence, risk aversion and another set of clearly behavioral aspects can have a determining effect on the financial decisions we make.

Hence the importance of a financial advisor who, with a much more rational and objective vision of what the client may have, makes him see the pros and cons of each decision.

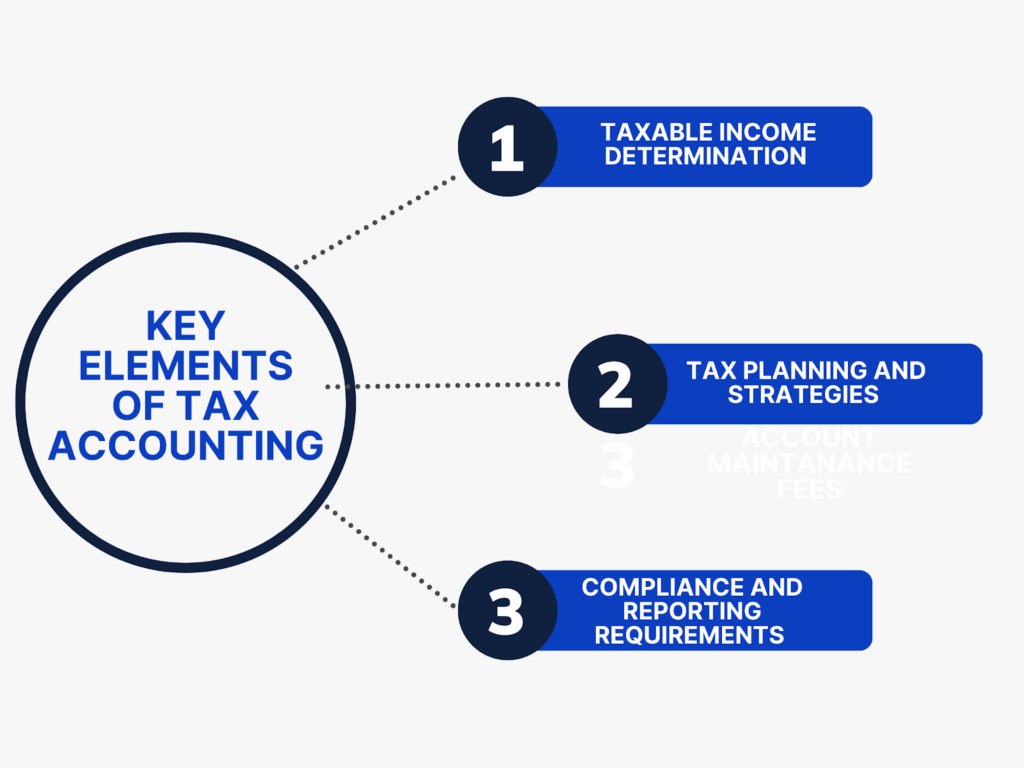

Facilitates tax planning

The financial advisor is able to provide the investor with ideas, strategies and tips for an intelligent tax planning, which allows him to comply with the law, but at the same time take advantage of the existing tax benefits to minimize the tax payment. The idea is to obtain the greatest possible profit of all rents.

Help avoid costly mistakes

Success in the financial field does not depend solely on technical knowledge and access to information. It also influences an objective mentality, have disciplined processes and constant monitoring of investments. The financial advisor is responsible for all this and much more, always watching over the interests of the client.

In general, people’s investment decisions are determined by what they see in the media or by the opinions of acquaintances. Serious error Investments must be planned based on specific objectives, and according to the client’s personal situation, the value of their assets, expenses, possible tax costs and conditions of the economy, among many other variables that can determine the success or failure of each investment.